Written by Nila Mohanan, Joint Secretary, Government of India, Indian Adminstrative Service

Across the globe, technology-driven financial innovations are swiftly ushering in an era of democratization of data. There is a palpable shift of power and agency from data holders to actual data owners, who are utilizing their financial information for accessing better fintech solutions. India's advances in digital public infrastructure have consistently focused on financial inclusion and the correction of information asymmetry as key priorities.

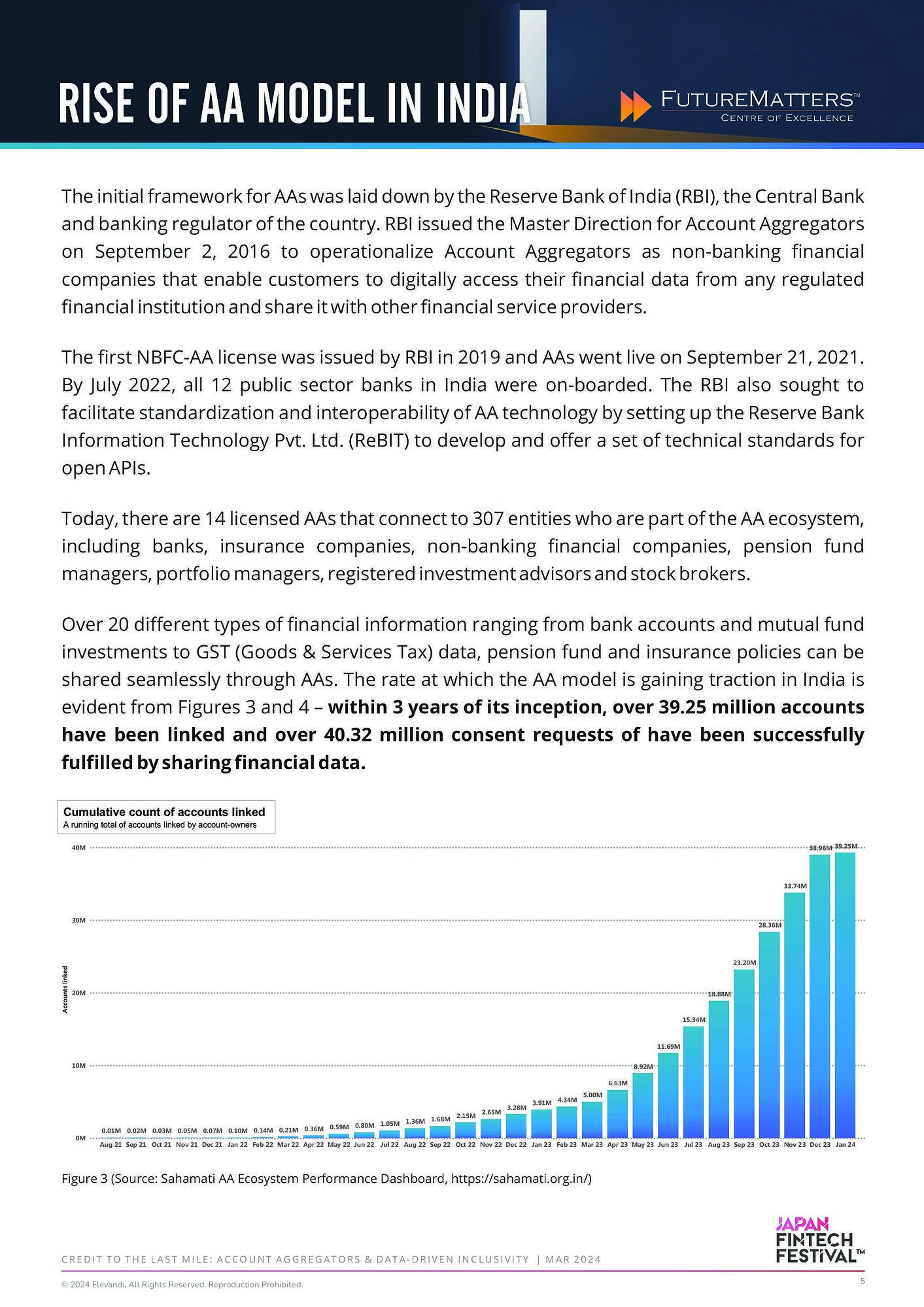

The immense possibilities thrown open by IndiaStack, the world's largest repository of open APIs (Application Programming Interfaces), are transforming the digital finance ecosystem in India. One of the most far-reaching initiatives is the Account Aggregator (AA) model, which went live in 2021 and is fast expanding its ambit and network. Seen in the larger global context of Open Banking, the AA model promises to unlock the full potential of financial data as a tool for inclusion and empowerment of Micro, Small & Medium Enterprises (MSMEs) as well as individuals, who have hitherto been under-served or unserved.

This piece looks at the AA model of India in the larger global context of open banking and the national context of the Data Empowerment and Protection Architecture (DEPA). It seeks to demonstrate the relevance of AAs through the use case of MSMEs and their credit linkages.

COMMENTS