Summary report written by Wee Kee Toh, Global Head of Business Architecture for Coin Systems at Onyx by J.P. Morgan, following a roundtable discussion which took place at Elevandi Insights during the Singapore FinTech Festival 2023

Key Insights From Discussion On: Open and Interoperable Networks

Public blockchain networks are designed to be open and accessible. While there are shortcomings, public blockchain networks can serve as a reference model for interoperability and interconnectivity, in the pursuit of designing open interoperable networks for the financial ecosystem.

The need for interoperability

Financial Institutions have been exploring the use of blockchains and the tokenization of financial assets as a means to bring parties together to transact on common platforms, and in doing so, improve liquidity and foster connected markets.

Financial Institutions have been exploring the use of blockchains and the tokenization of financial assets as a means to bring parties together to transact on common platforms, and in doing so, improve liquidity and foster connected markets.

However, enterprise blockchain implementations within financial services have tended towards private networks. The proliferation of private, often closed-loop, single-purpose networks could potentially increase the fragmentation of existing markets and liquidity. There needs to be a pathway of crossing this valley of fragmentation, to allow for interoperability across tokenised assets and interlinking across heterogenous digital asset networks towards a future of tokenised assets and currencies, which is more open and interoperable.

Public blockchain - a reference model for openness and interoperability

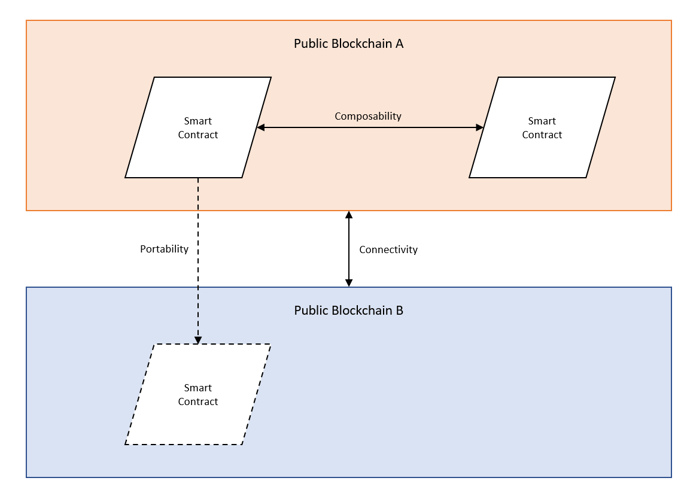

Public blockchains are designed to be open and accessible to all parties. They enable the concept of composability, where applications can interact seamlessly with other applications deployed on a common platform.

Public blockchains are designed to be open and accessible to all parties. They enable the concept of composability, where applications can interact seamlessly with other applications deployed on a common platform.

However, public blockchains suffer from significant shortcomings that limit their utility for regulated financial institutions. For example, there are concerns around governance of public blockchains, such as a lack of legal entity that is responsible for the network, lack of enforceable Service Level Agreements (SLAs) on performance and resiliency, and lack of certainty and guarantees around processing of transactions. These concerns mean that public blockchains are unlikely to meet current regulatory requirements or guidelines relating to technology risk management and outsourcing, and pose difficulties for financial institutions to use or deploy applications on them.

Nevertheless, public blockchain networks provide a reference model for interoperability and connectivity on multiple levels:

- Composability or connectivity between smart contracts within a common blockchain platform

- Portability of smart contracts across blockchains

- Connectivity across blockchains

Open and interoperable networks

The ideal end-state would be networks that are open and interoperable, where digital assets and currencies would be able to interact on common ledgers, bringing about benefits such as composability and atomic settlement.

The ideal end-state would be networks that are open and interoperable, where digital assets and currencies would be able to interact on common ledgers, bringing about benefits such as composability and atomic settlement.

Composability refers to the ability for applications to interact seamlessly with other applications built and deployed on a common platform. It enhances automation, including cross-industry automation across multiple parties. Financial Institutions will be able to build and deploy applications on the platform that can build on capabilities of other applications, providing a much richer and wider suite of services to users. Composability is a core concept in decentralised finance (DeFi), which is also being explored in an institutional setting, with potential use cases including automated market making that can automate foreign currency exchange and settlement.

Atomic settlement refers to the exchanges of digital assets and currencies in a single irreducible unit, with no possibility for desynchronised states for the different legs of the transaction. This can also be viewed as a mechanism for achieving Delivery-versus-Payment (DvP) and Payment-versus-Payment (PvP) where the exchange of assets and currencies are linked to reduce settlement risks.

While there are significant benefits to such an ideal state, this may not be immediately viable from a technology scalability and from a governance perspective. Technical performance and scalability concerns may limit the volume of transactions and number of use cases that can be supported on a single blockchain, though there have been recent breakthroughs in scaling technologies such as Layer 2s.

Governance considerations, such as difficulties in aligning interests across numerous parties, may limit the eventual size of the network even if technical scalability challenges can be solved. It is worth noting, however, that there are precedence of large scale networks within the financial industry, such as SWIFT, that connect over 11,000 financial institutions and corporations .

Interoperability across blockchains and other platforms

Aside from the adoption of a common platform, another means of alleviating the pains of fragmentation is to improve interoperability between platforms. The underlying concern of market fragmentation and liquidity fragmentation is that liquidity is trapped within markets, and cannot be deployed efficiently and expediently across markets. Improving connectivity between platforms could enable transactions to take place seamlessly in real time and around the clock, as well as help alleviate inefficiencies relating to long settlement cycles and limited overlap in operating hours due to time zone differences.

While much of the focus has been on interoperability across blockchain platforms, more should be done on interoperability between blockchain and conventional non-blockchain platforms. This could bring about benefits, such as enabling programmability using smart contracts for conventional payment systems. One example would be the Trigger Solution being explored by Deutsche Bundesbank, which looks at a DLT infrastructure that acts as a technical bridge between the RTGS component of T2 and Eligible Market DLT Platforms.

How do we get there?

While there is a general consensus of the different approaches to achieving interoperability and connectivity across different markets and networks , the financial industry is still far from achieving this vision. Getting there would require advances across technology, business and regulations.

On the technology front, the financial industry has been conducting proof-of-concept trials with different models and approaches for connectivity and interoperability. Such exploration helps with understanding the technology and the different design options, which is particularly important as we are just at the start of the journey. However, to get to the next level, the technology will need to be tested with live transactions under real world conditions, to understand the practicality and limitations of these designs.

On the business front, there needs to be clearer articulation of the benefits that interoperability can bring. Even while there are pains, legacy systems and models continue to work well. Without sufficient incentive to switch, inertia continues to impede the ability for the financial services industry to move forward.

Regulators also play a key role in fostering innovation, by providing a regulatory environment that is conducive to innovative use of technology. Regulatory sandboxes that allow experimentation with innovative financial services in limited-scale live trials, within a well-defined space and duration, is one means of doing so. An example would be the European Union’s DLT Pilot Regime, which provides a regulatory framework that supports the use of DLT across different use cases.

Achieving the ambition of a global financial network, that enables seamless integration of financial services across financial institutions for 24x7 real-time transactions, is viable. But it will require central banks, regulators and financial institutions to come together and collaborate on a global level to make it possible.

COMMENTS